OUTLINE

- Overview of the Vietnamese Health Sector

- Vietnam Medical Equipment Market

- Distributor

According to Decree 36, Class B, C, and D medical devices will only be required for a marketing authorization (MA) license to import starting January 1, 2019 onwards. During this transitional period, we may help you set foot in Vietnam by applying an import permit and handling importation to commercialize your products, in the meantime, prepare the submission dossier ready to face the upcoming regulatory changes (license) in 2019. For the manufacturers who are new to this market, we may help you connect with local distributors to make your marketing penetration less painful and more efficient.

a. Overview of the Vietnamese Health Sector

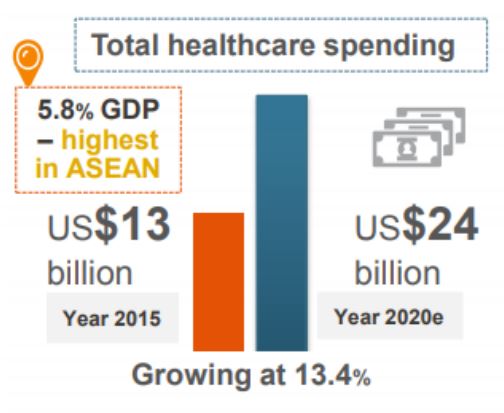

In recent years, Vietnam's health system has marked positive changes in the budget; The Ministry of Health has decided to spend $ 11.6 billion (equivalent to 6% of Vietnam's GDP) in 2015 and is expected to keep this number by 2020 to improve the quality of the health system.

(Source: Australia Unlimited)

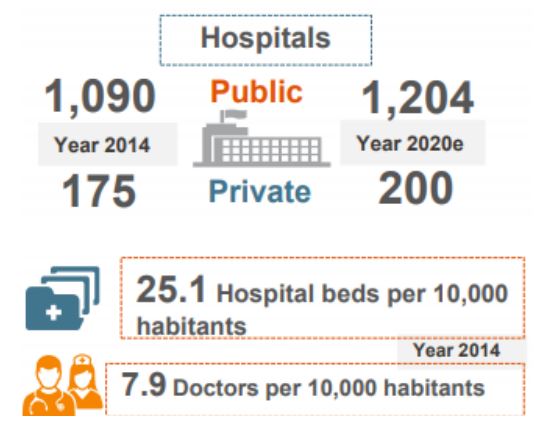

However, the public health system in Vietnam has not been effective. Hospitals in major cities like Hanoi or Ho Chi Minh City are often overloaded - they may need to operate at 200% capacity during peak hours - while local hospitals are not operating at all. One of the causes of this condition is the disposition and shortage of health professionals.

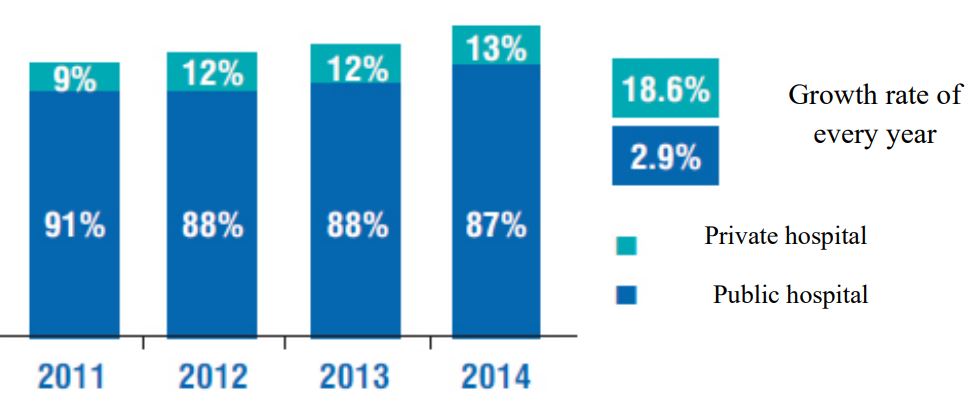

The private health system has grown tremendously since its inception in 1989. By the year 2015, 200 private clinics have been established to serve the middle class and are the ideal choice for those who can meet high medical costs. The average annual growth rate of private hospitals has reached an impressive 18.6% in 2011-14.

(Source: Australia Unlimited)

(Source: Vietnam’s MOH)

71% of public health facilities are located in the North. Hanoi is expected to receive a large portion of its budget to purchase modern and high-end medical equipment; In addition, due to the high quality of life, the development potential of Ho Chi Minh City is very promising, although the number of public health facilities in the city is less than some other provinces. In Ho Chi Minh City, it is estimated there will be about $900 million to upgrade medical equipment for hospitals from 2017 – 2019.

b. Vietnam Medical Equipment Market

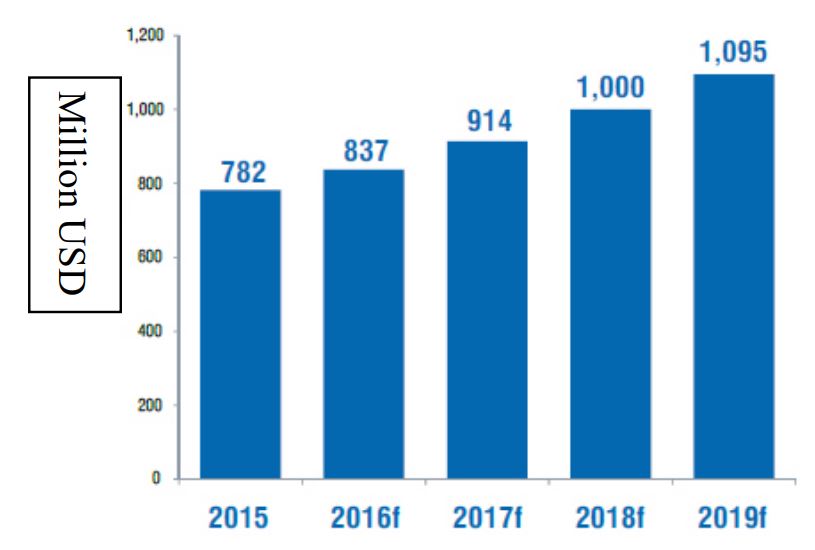

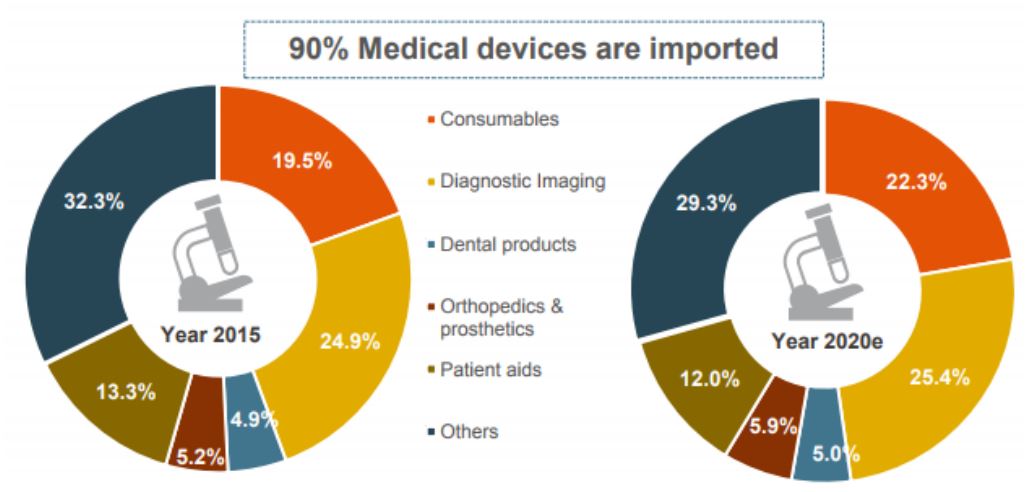

With the development of the sector, Vietnam's medical equipment market has grown steadily in recent years, reaching $ 781.8 million in 2015 and is expected to reach $ 1,095 million by 2019. However, 90% of the products on the market are now imported, especially in the premium segment such as imaging diagnose equipment. Up to 2015, local manufacturers only meet the demand for basic medical supplies such as beds or disposable items.

(Source: BMI)

Research shows that 90% of medical equipment in Vietnam is imported. Among them, 30% of the total import value of medical equipment is imaging diagnostic equipment, including magnetic resonance imaging (MRI) machines, CT scans, ultrasound and X-ray machines. The major countries supplying medical equipment to Vietnam are Japan, USA, Singapore, China and Germany, accounting for 55% of Vietnam's medical equipment imports.

(Source: Australia Unlimited)

In 2014, exports and imports of medical equipment reached US $ 751 million (up 127% from 2010) and US $ 707 million (up 44% from 2010). The US is the main export market for Vietnamese medical equipment - accounting for 23% of total export value of this market. Japan, accounting for 20% of total export value, is the second largest market of Vietnam and mainly imports of medical consumables.

As mentioned above, high end products such as imaging have imported origin (mainly from US, Japan and Germany). In addition, Vietnam has also imported many self-consuming medical equipment from Singapore (accounting for 19% of the total import value of the sector).

c. Distributor

There are only a few national level device distributors, but more than 1000 private distributors in Vietnam. The majority of Vietnamese medical device distributors are located in Ha Noi and Ho Chi Minh City.

There are four main classes of medical device purchasers. The largest are government-funded hospitals, which account for 70 percent of the market. Foreign-owned hospitals and clinics are also large purchasers; however, these facilities usually purchase supplies from their sponsoring country. Local private hospitals will show the strongest growth, while research and educational institutions will also account for some of the demand. Several medical education and research institutions are open to experimenting with new systems and innovative methods. These end-users present an excellent strategic opportunity to develop partnerships, given their desire to explore new technologies.

Public hospital purchases must be made through provincial or national bidding. Since foreign companies cannot submit a tender on their own, having a local distribution partner with strong technical skills and solid relationships with hospitals, healthcare facilities and the Ministry of Health is important for the success of your device in Vietnam.